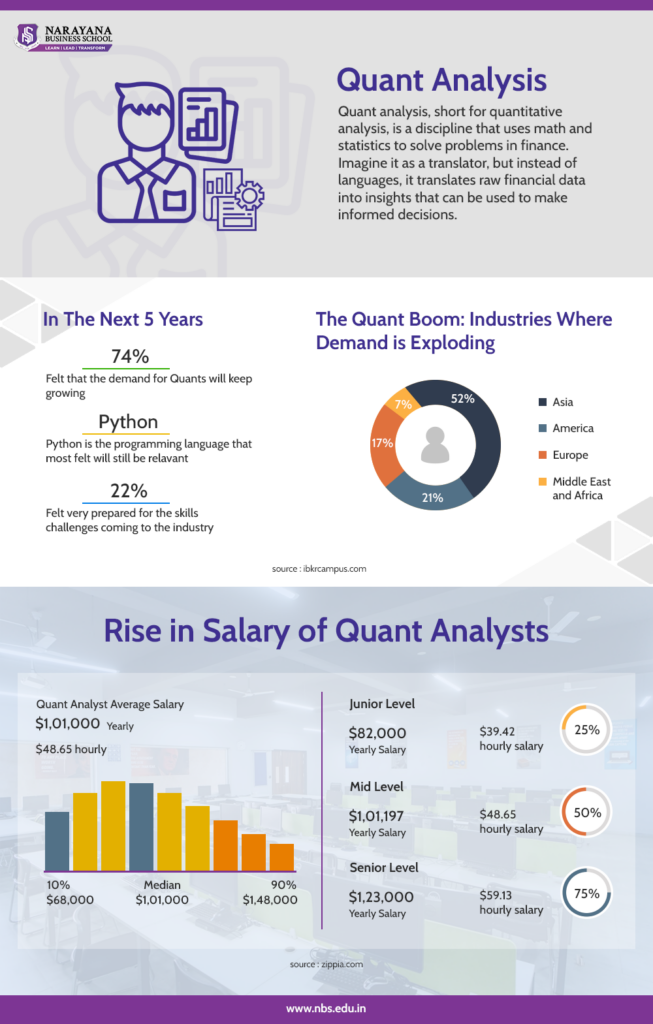

We see that there’s always a buzz about quantitative finance course in India where students and professionals want to know it all when it comes to learning via masters in finance as a career upgrade, becoming a quant analyst or a better management decision maker. We are living in the times where people are curious about how the world of finance works, how to analyze risk, investments, and make high end finance related decisions. Why is that?

The potential of general curiosity among people is on a rise, every student or professional is in search for a better alternative to stand out from the crowd. Now, you don’t stand out from the crowd by doing the ordinary, let alone get a simple degree in finance. This is why there’s an upsurge for the demand for learning quantitative finance as a major. Learning quantitative finance is essential in today’s data-driven world, where financial markets are increasingly complex and interconnected. As a quantitative finance expert, you’ll lead financial innovation by creating algorithms for high-frequency trading, optimizing portfolios, and predicting market trends with precision.

Considering the immense value and career potential of quant finance, we have partnered with industry leaders to develop a customized EY CAFTA program integrated with our Quantitative Finance curriculum. This exclusive combination provides you with the advanced skills and real-world insights needed to excel in high-frequency trading, portfolio optimization, and market prediction.

By enrolling in this tailored pgdm finance course, you’ll gain a significant edge in the competitive job market, positioning yourself as a top candidate for lucrative roles in investment banks, hedge funds, asset management firms, and fintech companies. Our team of finance experts wants you to learn quantitative finance the best way possible.

What Is EY CAFTA? One Of The Best EY Courses

The EY CAFTA (Certificate in Applied Finance, Treasury, and Analytics) program is a highly regarded certification designed by EY to equip finance professionals with advanced skills in finance, treasury, and analytics. This program covers critical areas such as cash management, investment management, and financial risk management. It’s a better alternative to a diploma in treasury investment and risk management. Professionals engage in rigorous academic training complemented by practical applications through live workshops, real-world case studies, and simulations.

What Makes The EY CAFTA Program Different From Other Finance Courses?

The EY CAFTA program distinguishes itself from other finance courses through its comprehensive and practical approach to education. Unlike typical finance courses that may focus solely on theoretical concepts, the EY CAFTA program integrates theoretical knowledge with practical applications.

This integration is achieved through live workshops and real-world case studies, providing participants with hands-on experience and practical insights. Furthermore, the program is continuously updated to reflect the latest industry trends and technological advancements, ensuring that the curriculum remains relevant and up-to-date. The involvement of industry experts and leaders in delivering the program content further enhances its value, providing participants with firsthand insights from those at the forefront of the finance industry.

Students can even take part in the CAFTA case championship held every year. The EY CAFTA Case Championship is a dynamic competition tailored for ambitious students eager to showcase their skills in finance, treasury, and analytics. Participants work in teams to tackle real-world financial problems, honing their analytical and strategic thinking abilities. Winning teams gain significant recognition and potential career opportunities with EY, making it an invaluable experience for finance enthus.

Ernst & Young also offers ey financial modelling course which is a top-tier e-learning program designed to teach you the essentials of financial modeling, including data analysis and business valuation techniques. This course is perfect for finance enthusiasts aiming to enhance their career prospects.

To truly excel in financial modeling, consider the integrated Quantitative Finance program at NBS. This program goes beyond basics, combining rigorous quantitative analysis with advanced financial modeling.

EY CAFTA Program At NBS vs. Regular EY CAFTA

In the age of everyone trying to find a competitive edge, 90% of the masses end up finding none. The reason being all of us take a similar route thinking that we are the price. Turns out, a lot of people took the same route and now stand at the same position in an effort to find a higher edge. It’s like going to an off-beat place because a travel influencer said so, and now fifty thousand of you are in that off-beat location. Guess what? It’s not offbeat anymore.

At Narayana Business School, we offer hyper focused post graduate programs that give you a real competitive edge over your competitions. With the same energy, our historic collaboration with EY for its CAFTA program, made us the first and top B school in India (west) to do so giving India one of the best finance courses.

| Criteria | EY CAFTA With QF Program | Regular EY CAFTA |

| Mode Of study | Full Time – Offline | Hybrid E-Learning |

| Duration | 24 Months | 90 Hours |

| Industry Collaborations | Collaborations with top financial institutions | Standard industry connections |

| Faculty | Taught by industry leaders and top academics | Delivered by experienced professionals |

| Curriculum | Trimester Quantitative Finance Curriculum with focus on finance, treasury and analytics | Focus on Finance, Treasury, and Analytics |

| Program Flexibility | Tailored electives to match career goals | Fixed curriculum |

| Hands-On Experience | Extensive Hands-on projects and simulations | Limited practical applications |

| Capstone Projects | Real-world capstone projects with industry mentors | Basic capstone projects |

| Certifications | 14 Certificates after completing each module | 1 certificate after completion |

| Workshops | Exclusive workshops on high-frequency trading, risk management and portfolio optimization | Workshops on finance |

| Scholarships/Funding | Availability Of merit-based scholarships, education loan and financial aid | Limited scholarship opportunities |

| Reward | Full Time Degree with 14 EY module certifications | 1 EY CAFTA certificate |

| Alumnus Status | Both NBS Alumnus and EY Alumnus Status | EY Alumnus Status |

India’s First And Only Quantitative Finance Program (PDGM): An Overview

About a few years ago, before integrating EY’s CAFTA program in treasury, analytics and applied finance, our board of studies (BoS) discussed the unrealized and prospective opportunities for best masters in finance courses in India.

We observed it first hand. The gap between learning online vs offline, learning just applied finance vs learning in depth quantitative finance, professionals looking for a career switch in finance but settling for one certification program, graduate students confused on which finance course to take for higher studies.

Narayana Business School was founded by two great academicians, Dr Amit Gupta and Dr. Purvi Gupta, India gold medalist in the field of finance and certified chartered accountants. We had to deliver the finance education in India, it is our core, our DNA, our identity and most sought after program. We introduced the opportunity of completing international CFA with us along with the quantitative finance program but we wanted to up a notch. Like we said, in an attempt to provide better targeted education, we wanted to provide the best. We want you to have a REAL competitive edge in 2024 and the decades to come.

Following which, NBS, having a recruiter network and industry connections of 670+, we dug and found EY to be the best for what we already deliver in finance. Tied up with EY to provide one complete quantitative finance course that opens all possibilities for you as a finance expert. The REAL edge.

We called it NBS x EY

The integration of the Quantitative Finance curriculum with the EY CAFTA program at NBS ensures a well-rounded education. This unique combination of finance, analytics, and quantitative methods makes graduates more versatile and highly competitive in the job market.

Our approach towards holistic education and providing the best experiential learning possible, students at NBS benefit from extensive hands-on projects, real-world simulations, and practical workshops. These experiences provide valuable practical knowledge, essential for thriving in the finance industry.

The program’s strong partnerships with top financial institutions offer students unparalleled networking opportunities, internships, and job placements.

Your network is your net worth

The program is taught by a mix of leading academics and industry professionals. This ensures that students receive a balance of theoretical knowledge and practical insights, learning from the best in the field. Learn from the pioneers and innovators in finance.

With a dedicated placement cell and a high placement rate, students are well-supported in securing lucrative roles in the finance sector post-graduation. The program’s comprehensive career development services are designed to help you achieve your professional goals. Step into your dream job with confidence and support.

International study tours and exchange programs provide students with a global perspective on finance. This exposure enhances their learning experience and significantly boosts their career prospects. See the world, learn from the best, and broaden your horizons.

These criteria collectively illustrate why the NBS EY CAFTA program, integrated with Quantitative Finance, offers a superior education and better career opportunities compared to the regular EY CAFTA program. Stand out in the crowded finance job market with a truly unique qualification.

For graduate students and professionals looking for a career change, this program is an exceptional choice. It not only equips you with advanced skills but also provides the practical experience and industry connections needed to excel. With expert faculty, dedicated career support, and global exposure, the NBS EY CAFTA program positions you at the forefront of the finance industry, ready to tackle complex financial challenges and lead with confidence. Transform your future—embrace the path to excellence.

Become a master in finance, quant finance, better professional after graduation, career advancement after CA or CFA.

We crafted something which is suitable for every student and professional whether you are seeking for pg diploma in banking and finance, financial risk management course, quantitative trading course or ms in finance. This surpasses bits pilani mba, jbims msc finance, coursera quantitative finance and many others

The Curriculum – NBS x EY

The Quantitative Finance program at NBS Ahmedabad provides a comprehensive education in finance, blending theoretical knowledge with practical applications. The curriculum includes:

- Managerial Accounting: Fundamentals and their applications in decision-making.

- Corporate Finance: Advanced financial strategies and analysis.

- Financial Mathematics: Quantitative techniques in finance.

- Machine Learning using Python: Modern data analysis and predictive modeling.

- Financial Econometrics: Statistical methods in finance.

- Derivatives Pricing: Valuation of financial derivatives.

- Risk Management: Techniques to identify and mitigate financial risks.

- Quantitative Asset Management: Advanced portfolio management strategies.

- Financial Engineering: Development of new financial instruments and strategies.

EY CAFTA Curriculum

The EY CAFTA (Certificate in Applied Finance, Treasury, and Analytics) program further enhances the curriculum with specialized modules, including:

- Understanding Risk: Basics of risk assessment and management.

- Financial Markets: Comprehensive understanding of financial markets.

- Investment Management: Advanced techniques in investment management.

- Financial Risk Management: Strategies for managing financial risks.

- Corporate Finance: In-depth corporate finance strategies.

- Data Analytics: Introduction to Power BI and data analytics.

Imagine the advantage of having access to both a comprehensive Quantitative Finance curriculum and the esteemed EY CAFTA program in one seamless educational experience at NBS. This unique integration means you are not only learning advanced financial theories and quantitative methods but also gaining practical insights from industry leaders. With subjects ranging from Managerial Accounting and Corporate Finance to Financial Risk Management and Data Analytics, the curriculum is meticulously designed to prepare you for every facet of the finance industry.

Here’s your opportunity to learn finance via data. Know the top 10 data science tools to use in 2024

At NBS, we’ve customized the EY CAFTA program to perfectly align with our rigorous Quantitative Finance curriculum, ensuring that you receive a holistic education tailored to current industry demands.

The program is delivered and taught by our experienced faculty who follows the unique teaching pedagogy of experiential learning, subject matter experts with vast experience in various sectors, including banks, NBFCs, and corporates.

The fusion of these programs means you benefit from hands-on projects, real-world simulations, and invaluable networking opportunities with top financial institutions.

Picture yourself not just learning, but applying complex financial strategies and analytics, preparing you to excel in roles that require both depth and breadth of knowledge. This integrated approach guarantees that you are well-equipped to tackle complex financial challenges and lead with confidence in your career.

Conclusion: Secure Your Future With One Of Its Kind PGDM in Quantitative Finance Program

The integrated EY CAFTA Program at NBS stands out as a pioneering educational path for those aiming to excel in the competitive field of finance. This program, blending the rigorous Quantitative Finance curriculum with the prestigious EY CAFTA certification, offers a holistic and advanced learning experience.

Students not only gain deep theoretical knowledge but also benefit from practical applications through hands-on projects, real-world simulations, and industry workshops. This comprehensive approach ensures that graduates are well-prepared to tackle the complexities of modern finance and secure lucrative roles in top financial institutions.

Don’t settle for ordinary. Embrace the extraordinary with the NBS x EY integrated program. Take the leap towards a future where your skills are not just relevant but revolutionary. The world of finance is evolving rapidly, and with it, the demand for highly skilled quantitative finance professionals.

Enroll now to secure your place among the elite, to transform your career, and to become a leader in the finance industry. With the NBS x EY program, you’re not just learning finance; you’re mastering it