Wealth is a significant factor in everyone’s life nowadays. Everyone tries to get a consistent source of wealth to maintain the particular living standard they want to have. Here a choice comes in between, that is, what to choose – a job or starting a business.

Not to forget, each has its own pros and cons, but it is totally dependent on the individual’s perspective. This is based on the individual’s personal circumstances, financial goals, and risk tolerance.

Most successful employees don’t just “have jobs” – they run their careers like businesses. They negotiate, pivot, upskill, and strategically position themselves. Similarly, many business owners who succeed don’t just “own businesses” – they approach their ventures with the discipline and consistency typically associated with high-performing employees.

Here is a detailed comparison of jobs and businesses, including the notion that even jobs can create wealth with consistency.

Understanding Jobs And Businesses

Jobs involve working for an employer in exchange for a salary or hourly wage. Employees perform specific tasks and responsibilities which they are expected to do, often within a structured environment, with limited control over their work conditions and outcomes.

Businesses, on the other hand, involve entrepreneurship where individuals create goods or services to sell for profit. Here individuals work for themselves and provide employment opportunities for others as well. This brings greater autonomy but also comes with higher risks and responsibilities.

Why Should You Choose Job Over Business?

| Pros of Job | Cons of Business |

| Regular paychecks provide financial security, making it easier to manage expenses. | Starting a business involves significant financial investment and risk of loss. |

| Many jobs offer benefits like health insurance, retirement plans, and paid leave. | Entrepreneurs often work long hours, especially in the early stages. |

| Working in a structured environment often includes training opportunities that enhance skills. | Market fluctuations can impact business success unpredictably. |

| Jobs can offer predictable hours, allowing for a more balanced lifestyle. | – |

Why Should You Choose Business Over Job?

| Pros of Business | Cons of Job |

| Successful businesses can generate significant profits. | Salaries are often capped, limiting wealth accumulation. |

| Entrepreneurs have the freedom to make decisions about their business operations. | Employees typically have little say in company decisions or their work environment. |

| Business ownership can lead to substantial wealth accumulation over time. | Economic downturns can lead to layoffs or downsizing |

Even Jobs Can Create Wealth (With Consistency)

While many view jobs as merely a means to earn income, they can also be vehicles for wealth creation when approached strategically. Sahil Shah, Founder of Hungrito & Netsavvies, when asked shared that we are often not taught how to see things as the way they are. Not always businesses create generational wealth, not always businesses are rewarding and not always does business provide financial freedom. The question then becomes not which path to choose, but how to develop the adaptability to thrive on any path you find yourself on.

Here is how jobs can create wealth with consistency:

Maximizing Income Potential

Look for opportunities for bonuses or commissions within your job structure. Pursue promotions by enhancing skills through additional training or education.

Investing Wisely

Always prefer to allocate a portion of your salary towards investments such as stocks, bonds, or real estate. Consider retirement accounts like 401(k)s or IRAs that offer tax advantages.

Building Passive Income Streams

Use your earnings to start side businesses or invest in rental properties that generate passive income. Explore dividend-paying stocks or peer-to-peer lending platforms as investment options.

Networking and Personal Branding

Build relationships within your industry to open doors for better job opportunities or partnerships. Establish a personal brand that showcases your expertise, potentially leading to consulting opportunities.

Financial Literacy

Educate yourself on personal finance management to make informed decisions about saving and investing. Use budgeting tools to track expenses and maximize savings from income.

Long-Term Vision

Set clear financial goals that guide your spending and investment habits. Be patient; wealth creation through consistent saving and investing takes time but yields significant results over the long term.

How Can Jobs Contribute To Wealth Creation If They Don’t Pay Well?

- Create a budget that prioritizes saving and investing. Aim to save at least 20% of your income, directing these funds towards investments rather than merely accumulating cash.

- Take advantage of employer-sponsored programs such as matching contributions for retirement accounts. Engage in any available training programs that could lead to promotions or raises.

- Most importantly, get a mindset focused on growth and opportunity rather than limitations imposed by salary. Recognize the potential for wealth creation through consistent effort, strategic planning, and smart financial decisions.

How Financial Outcomes Are Affected With Job And Business?

This is pretty clear that financial outcomes will differ in both the cases of a job or a business. How you plan your expenses, what is your long-term goal, among other factors matter a lot to determine what would be the financial outcome of choosing a job or a business. For example:

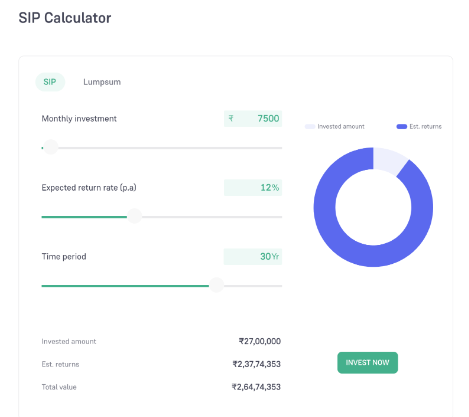

Job Scenario: An employee earning Rs. 50,000 annually with consistent raises and invests 15% into retirement accounts over 30 years. Assuming an average annual return of 12%, this employee could accumulate approximately 2.6 Cr by retirement.

Business Scenario: An entrepreneur starts a business with an initial investment of Rs. 50,000 and grows it to generate more than Rs 200,000 annually after five years. If profits are reinvested into the business at a growth rate of 10% per year over 30 years, the entrepreneur could potentially build a business worth 7 figure rupees.

What Factors To Consider While Choosing A Job Or Business To Start?

There are no particular factors to consider other than what is mentioned above. However, if you are confused between what to choose and what not then ask yourself the below questions with no bias. You will get the answer by yourself.

Risk Tolerance:

Are you comfortable with uncertainty and potential financial loss?

Financial Goals:

Do you aim for steady income or are you seeking high growth potential?

Work Style Preference:

Do you prefer structured environments or the flexibility of entrepreneurship?

Life Circumstances:

Consider your current financial obligations and family responsibilities.

Parting Thoughts: Job Vs Business – Which Is Better In India?

The decision to pursue a job or start a business is very personal and impacted by a variety of factors (risk tolerance, financial ambitions, and lifestyle choices). While choosing a job over business brings security and advantages, they may impede wealth building unless treated deliberately with the goal of maximizing income potential and prudent investment.

Choosing businesses over jobs, on the other hand, provides more chances for wealth generation while also introducing inherent dangers that must be carefully considered and planned for. Ultimately, both pathways may lead to financial success; it’s all about matching your professional decision to your own goals and situation.

Individuals may make well-thought decisions that set the road for their financial futures, whether through employment or entrepreneurship, by realizing that even occupations can generate wealth with constant work and smart preparation.